Exploring the landscape of vehicle insurance can often appear daunting. With the plethora of options offered, comprehending the nuances of your car insurance policy is vital for ensuring you have the right coverage that satisfies your demands. Whether you are a novice driver or a experienced on the road, familiarity with key terms and protections can help protect you in the event of an accident or unexpected circumstance.

In this article, we will break down the parts of auto insurance plans and clarify what each term means. By simplifying the language commonly associated with car insurance, we aim to equip you to make wise choices when choosing your coverage. With the appropriate knowledge, you can confidently choose a policy that not only meets legal requirements but also offers the peace of mind you deserve while driving.

Types of Auto Insurance

Regarding car insurance, understanding the different types available is crucial for selecting the right coverage for your needs. The primary type is liability insurance, that covers damages to third parties and their assets if you are at fault in an accident. This is often required by law and generally includes both bodily injury and property damage coverage. Liability insurance ensures that you can meet legal requirements and protect your financial interests in case of an accident.

Another important type of auto insurance is collision coverage, which helps cover repairs to your personal vehicle after an accident, no matter who is at fault. This coverage is especially beneficial for those with newer or more valuable cars, as it can save a significant amount of money in repair costs. Additionally, comprehensive coverage protects against non-collision-related incidents, such as theft, vandalism, or natural disasters. This type of coverage can give you peace of mind realizing that your vehicle is insured from a variety of risks.

Understanding these types of coverage can help you take informed decisions when choosing an auto insurance policy. Many drivers choose a combination of liability, collision, and comprehensive coverage to make sure they have a well-rounded protection plan. It's essential to evaluate your circumstances, including the value of your car and your budget, to choose the right types of auto insurance that suit your lifestyle and financial situation.

Key Coverage Terms

Understanding auto insurance demands acquaintance with several key coverage terms that influence your insurance policy. One of the most important is liability coverage, which shields you if you're responsible for causing an accident that injures others or damages their property. This coverage typically consists of a pair of components: bodily injury liability and property damage liability. Familiarizing yourself with these terms enables you determine the appropriate limits for your policy based on your financial responsibilities.

Another essential term is collision coverage. This type of insurance helps pay for the repair or replacement of your vehicle after an accident, irrespective of who is at fault. It's particularly valuable for modern or luxury cars, as it guarantees you won't face significant financial loss due to damages from accidents. Understanding collision coverage can help you determine if it's necessary for your specific situation and budget.

Comprehensive coverage is yet another important term to understand. This coverage shields your vehicle against non-collision related incidents, such as theft, vandalism, or natural disasters. It covers the gaps that collision insurance does not cover, ensuring you have broader protection. Knowing the difference between collision and comprehensive coverage is essential in creating a well-rounded auto insurance policy that fits your needs.

Factors Affecting Insurance Costs

Various important elements influence the expense of car insurance, with driving history being one of the most important factors. Insurers assess your history for any incidents or traffic violations, that can reflect how risky you are as a driver. A clean driving history typically creates reduced premiums, whereas accidents or speeding tickets can cause increased costs. Insurers may also take into account how many years you have been driving, where experienced drivers often enjoying more favorable rates.

One more important factor is the category of vehicle you drive. Cars that are higher-priced to replace usually come with higher premiums. Furthermore, vehicles with advanced safety features may be eligible for discounts, while those viewed as high-risk or more likely to be stolen can hike your rates. The years, make, model, and general safety performance of your vehicle are all taken into account when determining your premiums.

Geography has a crucial role in setting car insurance costs as well. Areas with higher rates of accidents, theft, or vandalism can result in increased premiums. Insurers examine regional data to assess risk levels, which means that drivers in urban settings may pay more than those in less populated settings. Recognizing how location affects your auto insurance can assist you foresee potential costs and make wise decisions about your coverage.

Frequent Exclusions

When assessing your auto insurance policy, it's crucial to be cognizant of frequent exclusions that may impact your coverage. One of the primary exclusions is loss caused by non-accident events, including natural disasters. Even though your car may be covered against accidents, many policies may not cover damages due to floods, earthquakes, or acts of God. This can leave policyholders exposed if they are situated in areas prone to such events.

Another significant exclusion involves the use of the vehicle. Most auto insurance policies do not cover damages that occur while you are operating the car for ride-sharing services or commercial purposes unless you have specifically selected a business-use or ride-share endorsement. If you carry out such activities without the appropriate coverage, you could face substantial out-of-pocket expenses in the event of an accident.

Additionally, operating a vehicle under the influence is a usual exclusion that can nullify your coverage entirely. If you are found to be impaired at the time of an accident, your insurer may refuse to pay for damages and injuries, leaving you liable for the costs. It's essential to understand these exclusions to ensure you have adequate protection and to purchase additional coverage if needed.

Filing a Insurance Claim

Filing a claim with your vehicle insurance company can be intimidating, but understanding the procedures can greatly simplify your journey. Start by gathering all necessary information regarding the accident, including the time and date, hour, location, and information of any other parties. Gather any records you have, such as photos of the damage, law enforcement documents, or testimonies, as these will support your case and provide background for your insurer.

Once you have all your information ready, contact your insurance company to initiate the claim submission. Most companies provide various ways to file a request, including web-based filing, phone calls, or mobile apps. Be prepared to provide the information you gathered, and be honest about the circumstances surrounding the incident. The claims representative will guide you through the details of what is needed for your situation.

After submitting, your insurance company will investigate the submission and assess the losses. They may reach out to you for additional information or to clarify information. Keep an open line of communication open and respond promptly to any requests. Once your request is approved, you will be notified about the following actions, including how reimbursements will be handled for repairs or medical expenses. It is essential to stay engaged throughout the procedure to ensure a hassle-free outcome.

Tips for Choosing a Policy

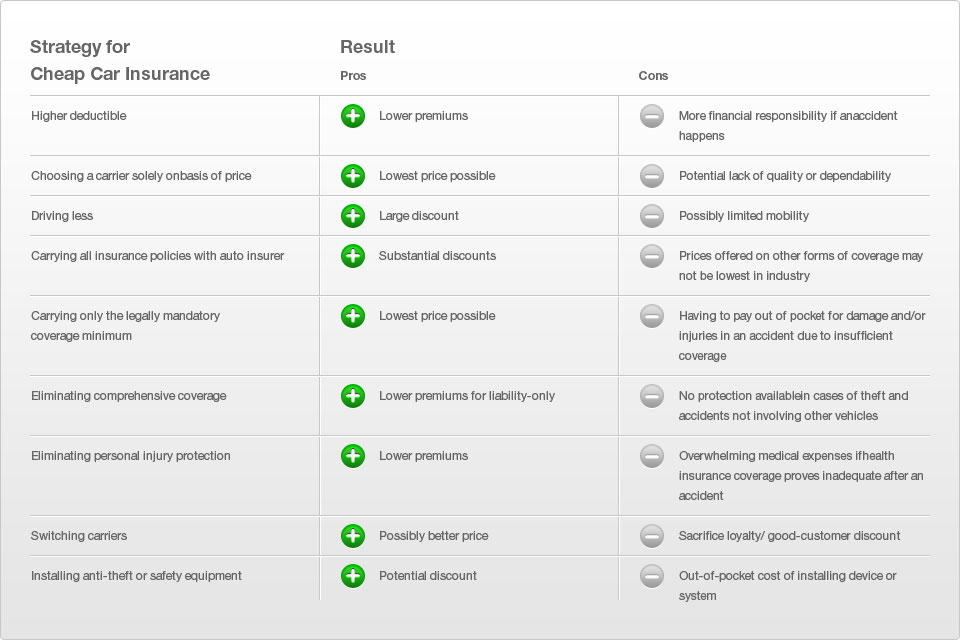

When choosing an auto insurance policy, first assessing your needs. Take into account aspects like your driving habits, the age and value of your vehicle, and how often you drive it. In case you have a newer or more valuable car, comprehensive coverage could be beneficial to protect your investment. Conversely, if your vehicle is older, you may want to focus on basic liability coverage to reduce premiums.

It's crucial to contrast quotes from various insurance providers. Different companies offer varying rates for similar coverage, and shopping around can reveal opportunities for savings. Don’t just look at just the premium price; take into account the deductibles, limits of coverage, and the standing of the insurer. Checking customer reviews and ratings can give insight into their reliability and claims process.

Finally, feel free to request discounts. Plenty of insurers offer reductions for safe driving records, bundling multiple policies, or possibly for being a good student. Inquire about any programs that may apply to you, and make sure to take advantage of them. Understanding cheap car insurance near Fort Worth, TX can greatly reduce your overall costs while guaranteeing you have sufficient protection on the road.