Locating inexpensive car insurance can seem like searching for a needle in a haystack. With countless options and varying prices, it is straightforward to become overcome by the process. However, understanding what defines cheap car insurance and recognizing your specific needs can convert this daunting task into a workable one.

Cheap auto insurance does not only mean selecting the cheapest price on the market. It entails securing a policy that balances good coverage with an reasonable premium. By examining different methods and considering various factors that influence car insurance rates, you can unlock the door to substantial savings while making sure that you and your vehicle are sufficiently protected.

Grasping Cheap Car Insurance

Affordable car insurance is an important option for many drivers looking to reduce their expenses while guaranteeing they remain protected on the road. very cheap car insurance no deposit texas of insurance generally offers coverage at reduced premiums, making it an tempting choice for cost-aware individuals and families. By grasping the various aspects of affordable auto insurance, you can make informed decisions and find the suitable plan that meets your needs without breaking the bank.

One key factor leading to the affordability of affordable car insurance is the array of coverage options provided. Typically, these policies may miss certain features or have higher deductibles compared to broader plans. Nonetheless, they can still provide essential protection against liability issues, collision, and other risks that drivers face daily. Examining your specific driving habits, vehicle type, and financial situation can help you find the right balance between cost and coverage.

Another important aspect of inexpensive car insurance is the various discounts that insurers may provide. These can include good driver discounts, multi-policy discounts for bundling car insurance with home or renters insurance, and discounts for low-mileage. By actively seeking out and inquiring about these discounts, you can additionally reduce your premiums and achieve a more cost-effective insurance solution tailored to your situation.

Factors Influencing Insurance Rates

Coverage costs for cheap auto insurance can vary greatly based on various key factors. One of the primary aspects is the driver's age and driving history. Younger drivers typically face higher premiums due to their lack of experience on the road, making them historically more likely to be involved in incidents. On the contrary, seasoned drivers with a clean history of cautious driving are often given with lower costs.

Another important element influencing auto insurance expenses is the category of vehicle being protected. High-performance cars or expensive vehicles generally come with higher premiums because they can be pricier to restore or substitute. Additionally, the vehicle's safety scores and theft statistics can also impact the cost of protection. Vehicles equipped with sophisticated safety technology may be eligible for discounts, making affordable car coverage more attainable for those drivers.

Lastly, the area where the vehicle is mainly driven plays a major part in deciding coverage costs. Urban areas with more traffic congestion and crime rates typically see increased costs compared to less populated regions. Providers often consider the risk of incidents and crime in specific locations, which can lead to substantial differences in premiums. Understanding these elements can help operators make wise decisions when searching for inexpensive coverage options.

Methods to Reduce Costs on Car Insurance

One practical way to reduce costs on inexpensive car insurance is by comparing quotes from different providers. Each insurer has its specific criteria for setting rates, so gathering quotes from various companies can reveal opportunities for significant discounts. Utilize online comparison tools to streamline this process, allowing you to evaluate coverage types and pricing rapidly. By exploring multiple policies, you may find a plan that offers superior coverage at a lower cost.

Another approach for lowering your premiums is to take advantage of discounts offered by insurance companies. Many insurers provide reductions for conditions such as having a safe driving record, combining policies, or completing a defensive driving course. Additionally, students with good grades and affiliates of certain trade organizations might also be considered for exclusive discounts. Always ask your provider about accessible discounts, as they can greatly reduce your overall costs.

Finally, consider changing your coverage choices to meet your present needs. If your vehicle is not new or has a low market value, it may not be essential to carry comprehensive or accident coverage. By changing to liability-only coverage, you could cut significantly on your premium. Just ensure that you evaluate your economic situation and safety needs before making any changes, as finding the right proportion between cost-effective coverage and adequate protection is crucial.

Types of Cheap Auto Insurance

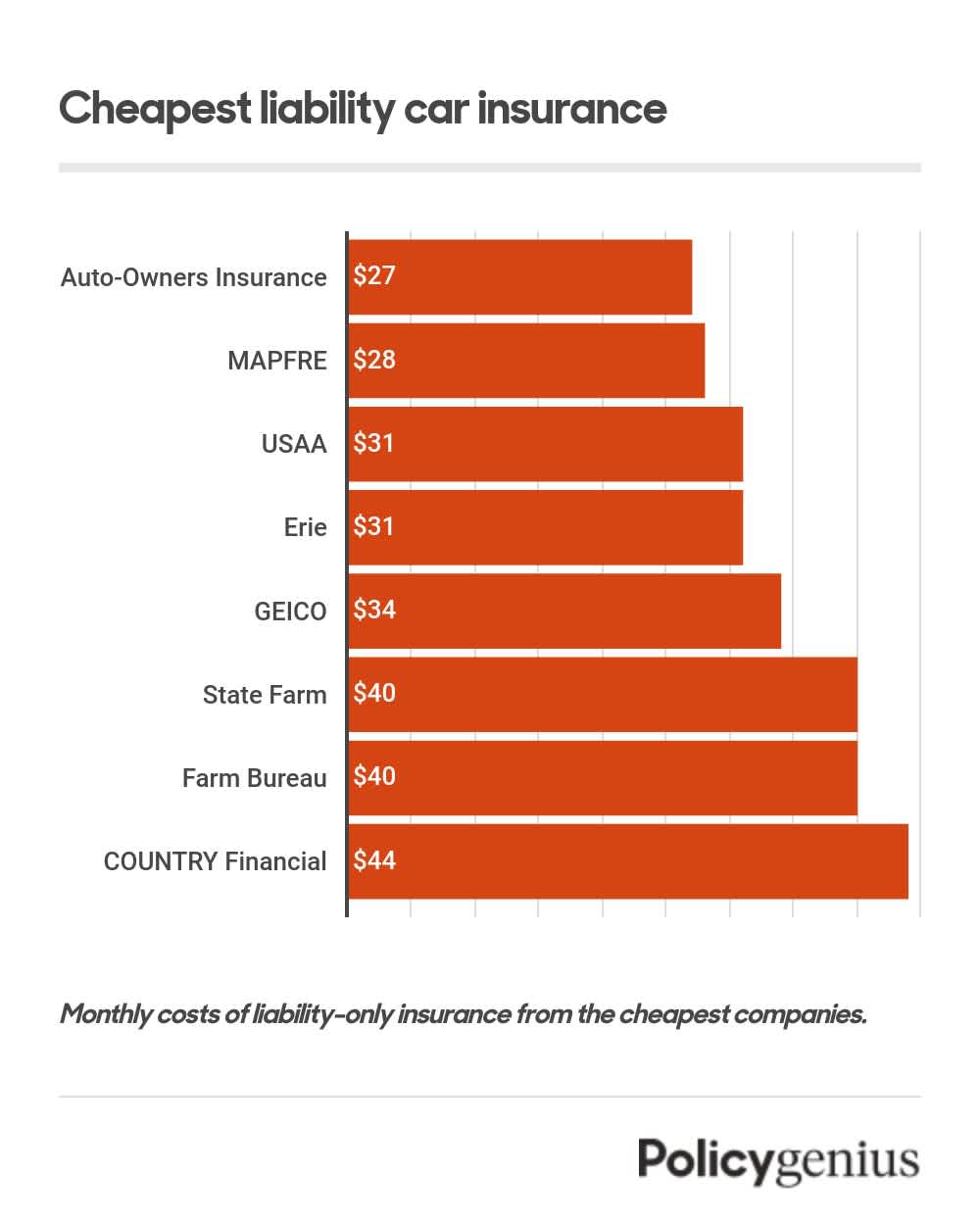

When searching for cheap auto insurance, it's essential to grasp the various types of coverage available. The primary form is liability insurance, which is mandatory in most states. This type of coverage shields you in the event that you cause an accident and are accountable for damages or injuries to another party. Although it provides important financial protection, it may not cover your vehicle in case of damage or theft, which makes it a cost-effective option for budget-conscious drivers.

An additional common type of cheap car insurance is collision coverage. This insurance pays for damages to your vehicle resulting from a collision with another vehicle or object, without considering fault. Even though collision coverage can increase your premiums, opting for a higher deductible can help lower costs. For those driving older cars, this may be a reasonable option, as the risk of high repair costs is more manageable.

Comprehensive insurance is also a key player in the world of cheap auto insurance. This coverage protects against non-collision-related incidents, such as theft, vandalism, or weather-related damages. Though comprehensive coverage usually comes with an additional cost, it can be a wise investment for drivers who want peace of mind. Evaluating your vehicle's value against the cost of comprehensive insurance will help determine if it is a worthwhile option for you.

Evaluating Insurance Companies

As you begin hunting for affordable cheap car insurance, it is essential to compare different insurance providers to discover the most suitable option suitable for your requirements. Different providers offer different costs, policy options, and discounts. Dedicate the time to gather price quotes across various providers, as this will help you to comprehend the cost range for the insurance you need. Certain can give cheaper prices due to unique pricing models, so exploring various choices might show considerable reductions.

In addition to reviewing quotes, it's important to evaluate the reputations and client support. Search for companies that have robust economic health and high satisfaction scores. Reading reviews online and verifying scores through organizations including J.D. Power & A.M. Best gives understanding of how each company handles its customers and manages claims. Having a low premium is of little value if you face issues when it's time to use your insurance.

Finally, keep an eye out for discounts that may be available that aren’t immediately clear. Numerous providers provide savings for safe driving habits, combining insurance policies, or even for membership in specific groups. Being aware of all the available discounts can significantly lower your total expenses. Through thorough comparison of providers, you can find affordable protection and obtain inexpensive vehicle insurance which fulfills your requirements.

Finding Discounts and Offers

When on the hunt for cheap car insurance, it is crucial to investigate different discounts and offers. Many insurance companies provide reduced rates for particular groups or situations. For example, young drivers may gain excellent student discounts if they maintain a good GPA, while seniors can look for exclusive rates tailored to their needs. Additionally, combining multiple policies, such as home and auto insurance, often leads to substantial savings.

Another way to access cost-effective coverage is by leveraging safe driving discounts. Insurers frequently reward policyholders who maintain a clean driving record without accidents or traffic violations. Furthermore, enrolling in defensive driving courses can also lead to lower premiums. Regularly reviewing with your provider for any discounts and adjusting your policy can help confirm that you are getting the best deal.

Lastly, take into account checking for loyalty discounts if you have been with your insurance provider for numerous years. Many companies recognize long-term customers by giving reduced rates as a benefit for their commitment. It is also sensible to look around and evaluate rates from different insurers to discover any promotional deals they may currently provide. Being proactive about looking for discounts can lead to significant savings on inexpensive auto insurance.

Typical Misconceptions About Budget Coverage

One frequent misconception regarding budget auto coverage is that it invariably means inferior quality protection. Many people assume that if they spend less, they get less benefit. In fact, there are numerous cheap options available that still offer significant protection. Different insurance companies may provide reduced rates due to fierce offers, proficient risk management, or by tailoring plans to meet distinct driver needs without undermining on coverage.

Another misconception is that budget car insurance is only appropriate for unsafe drivers. While it is correct that drivers with a history of incidents or tickets may be seeking for more budget-friendly options, many careful drivers can also discover inexpensive policies that suit their financial situation. Coverage providers often reward safe driving behaviors and excellent credit scores, allowing even responsible drivers to benefit from lower premiums without sacrificing their protection.

Finally, numerous believe that cutting coverage limits or choosing increased deductibles is the only way to get budget auto coverage. While these strategies can lower premiums, they may also increase financial risk in the event of an incident. It's crucial to find an adequate compromise between cost expenses and coverage levels, guaranteeing that motorists maintain adequate protection on the road while still benefiting inexpensive coverage premiums.

Ultimate Tips for Affordable Coverage

While searching for affordable auto insurance, don’t dismiss the importance of comparison shopping. Different insurers frequently provide vastly diverse quotes for the same insurance. Spend the effort to gather numerous quotes from multiple providers, and use online comparison websites to accelerate the process. This will help you recognize which companies offer the lowest rates for your specific requirements.

Moreover, consider altering your coverage choices. Though it might be tempting to choose for the lowest possible cost, ensure you are not giving up essential coverage. Review your deductibles and limits, and explore options like increasing your deductible for lower premiums. However, be cautious—higher deductibles mean greater out-of-pocket costs in the event of a accident.

In conclusion, take benefit of discounts. Many insurance companies offer discounts for different reasons, such as good driving records, combining policies, or even being a participant of certain organizations. Make sure to check about all possible discounts that may apply to you. Taking advantage of these possibilities can significantly cut your overall costs and make cheap car insurance even more cost-effective.